Donor Acknowledgement Letters: How to Get Them Done Right

Annual Tax Summaries Should Be Both Transactional and Relational

For one more moment, let’s savor your year-end fundraising success. You worked really hard to steward your donors for months and you should feel really good about all the work you did.

With that said, it’s time now to turn to your donor acknowledgement letters. While it’s not in the IRS code, most nonprofits have these annual tax summaries out to donors by January 31. So there’s no time to waste!

But donor acknowledgement letters are not just a donor thank you with a gift amount. When done correctly, they’re both a legal record and a donor stewardship and retention tool.

Annual tax summaries: the transaction part

First, let’s talk about the science, or legal, part. IRS Publication 1771 states that a donor cannot claim a tax deduction for any single contribution of $250 or more unless they have a “contemporaneous (read: timely), written acknowledgement of the contribution” from you.

Now as a nonprofit, you’re not going to get in trouble from the IRS for not sending out tax summaries to donors. But it’s just good stewardship to make it as easy as possible for your higher-dollar donors to claim their tax deduction.

Which brings me to the written part. The IRS lays out specific instructions for what needs to be in the document:

1. Your organization’s name (Your official tax name is best)

2a. The amount of cash contribution, or

2b. A description of a non-cash contribution, but not the value

3a. A statement that no goods or services were provided by your organization in return for the contribution, if that is indeed true, or

3b. A description and good faith estimate of the value of goods or services, if any, that your organization provided in return for the contribution (e.g. comped event ticket), or

3c. In the case of religious organizations, a statement that goods or services provided in return for a contribution consisted entirely of intangible religious benefits

The IRS states that you don’t have to include the donor’s Social Security Number or tax identification number on the communication.

Nor do you have to make it an attractive piece that warmly reminds donors why they gave to you. But you should, if you care about deepening the relationship with your donors.

Donor Acknowledgement: the relationship part

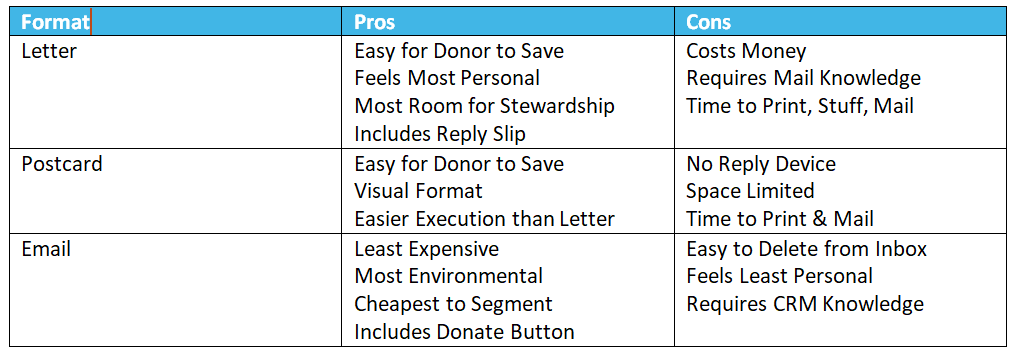

Which brings us to the art, or format, of your donor acknowledgements ... The IRS says your annual tax summaries can be a letter, a postcard, or even an email. But in choosing a format, you need to think through a few issues that tend to be more emotional than strictly logical.

The first is, “what format provides the best user experience for your donors?” Are your donors younger (or more tech savvy) and prefer to dig through their email inboxes when they’re doing their taxes?

Or would they prefer to receive a piece of paper – a donor acknowledgement letter or postcard – that they can store with their tax forms until it’s time to file?

A second issue to consider is whether you’d like your tax summaries to potentially generate new donations. After all, gift recency is one of the biggest indicators that a donor will give again.

Now I’m not talking about including a hard ask like the one in your year-end appeal. Just think about whether you plan to make it easy for a donor to give again (if they want to) by including a reply slip or donate button in your tax summary.

Here’s the emotion part. Some folks think it’s just plain rude to acknowledge a donation and ask again, even indirectly. Nonprofits that struggle to execute consistent donor communications throughout the year sometimes feel this way.

But many experienced fundraisers have told me just the opposite: That it’s always their job to make it easy for a donor to give – when he or she wants to. Assuming a donor won’t give is what’s rude in the minds of these fundraisers.

Our advice? Pull and analyze your donor response data. Your donors are constantly telling you what they do and do not like. Listen to them.

A third consideration is space. Donor acknowledgements are usually briefer and more easily scanned than a donor engagement piece that tells a full story.

However, I don’t think you should miss this chance to connect emotionally with your donors early in the year.

Briefly tell them what their donations already made possible, and how their support will be important in the year ahead. And include a great photo that captures the essence of your mission!

Striking a balance

Finding the right balance between meeting the donors’ transactional and relational needs can be challenging. You need to have your donor data in shape and write crisply to both needs.

We’d be happy to talk with you about what makes the most sense for your donor acknowledgements. Or give you a hand with data, writing, and distribution if you’d prefer to focus your time on the new year ahead.